Analysis of the Development Trend of China's Alumina Fiber Industry in 2023: Domestication is Accelerating, but Still Unable to Meet Actual Applications and Needs [Figure]

Source: Zhiyan Consulting

Overview: Currently, under the dual promotion of domestic policies and demand, the overall supply of alumina fiber in China continues to grow, but it is still less than one thousand tons. Specifically, China's alumina fiber production has increased from around 102.8 tons in 2017 to 653.5 tons in 2022, but it is still significantly lower than domestic demand. Data shows that China's alumina demand in 2022 was 897.9 tons, and the overall domestic supply can only meet about 70% of the demand.

Keywords: alumina fiber production, alumina fiber market size, alumina production capacity

1、 Overview of Alumina Fiber Industry

Alumina fiber is an inorganic fiber with excellent properties such as high strength, high modulus, and corrosion resistance. The main preparation methods of alumina fiber include Benemen method, melt spinning method, impregnation method, prepolymerization method, slurry method, sol gel method, electrospinning method, etc. The characteristics of alumina fibers prepared by different methods vary greatly. From the perspective of subdivision methods, the Bu Nei Men method and the melt drawing method belong to traditional preparation methods. The prepared alumina fibers have problems such as poor strength, brittleness, and low specific surface area. An effective way to solve these problems is to reduce the diameter of alumina fibers; However, the alumina fibers prepared by impregnation, pre polymerization, and slurry methods are insufficient to meet the market demand; At present, the widely used preparation method is mainly to combine the sol gel method with the electrospinning process to produce high-performance alumina fibers that meet the market demand.

2、 Alumina fiber policy and industrial chain impact

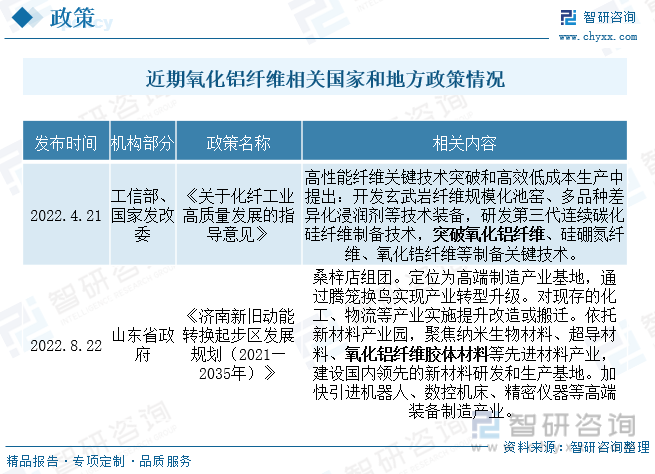

Aluminum chloride fiber has a wide range of applications, and high-performance composite materials prepared by aluminum chloride short fiber composite can be used in industrial high-temperature furnaces; Aluminum chloride continuous fiber-reinforced composite materials have excellent properties such as high strength, high modulus, and high stiffness, and are expected to become a substitute material in the high-temperature field with enormous development potential; Functional aluminum chloride nanofibers not only possess the aforementioned properties, but also exhibit excellent properties such as low thermal conductivity, electrical insulation, and high specific surface area. They are widely used in reinforced composite materials, high-temperature insulation materials, catalytic filtration materials, and other fields. In April 2022, two ministries and commissions issued the "Guiding Opinions on High Quality Development of Chemical Fiber Industry", which pointed out the need to break through alumina fiber technology and drive the overall high-quality development of the chemical fiber industry. In addition, local policies such as Shandong have also begun to introduce relevant policies to promote the development of local alumina fiber related industries. Under the promotion of national and local policies, China's alumina fiber technology and scale will continue to improve.

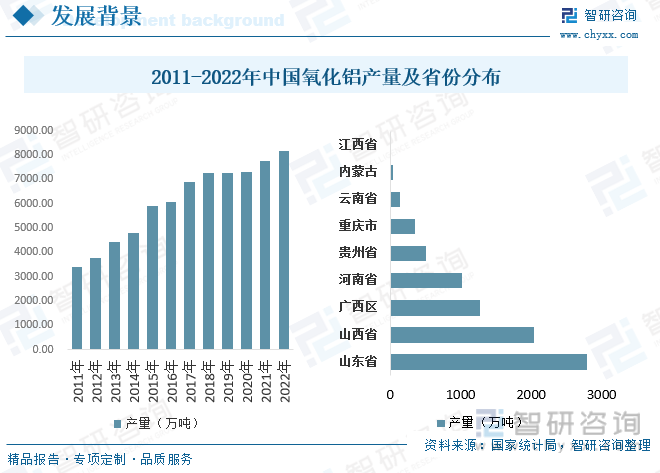

The main component of alumina fiber is alumina, and the fiber also contains a certain amount of other components such as SiO2, B4C, Fe2O3, ZrO2, and MgO. Although there are relatively few local resources of bauxite, the upstream raw material for alumina production in China, in recent years, with the import of overseas ores, China has developed into the world's largest producer of alumina. According to data from the National Bureau of Statistics, China's alumina production has continued to grow since 2011. As of 2022, China's alumina production reached 81.862 million tons, an increase of 5.7% compared to 2021. In terms of provincial and municipal distribution, the production distribution is relatively concentrated, with the top ten provinces accounting for 98% of the country's alumina production.

3、 Global Development Status of Alumina Fiber

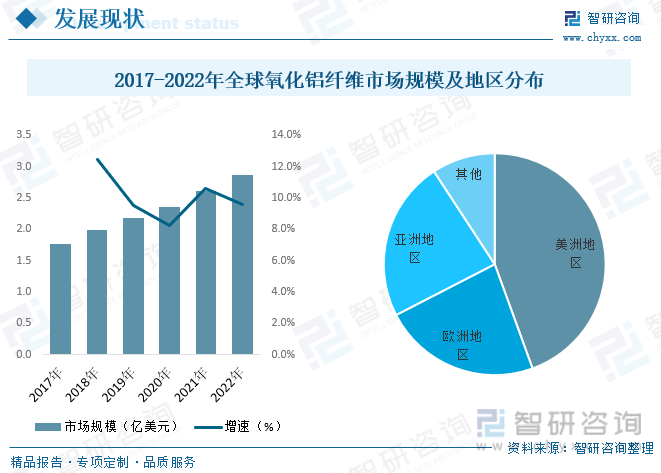

As one of the sub categories of ceramic fibers, alumina fiber has grown from $177 million in 2017 to $286 million in 2022 globally in recent years with breakthroughs in industrial technology and expansion of downstream demand. In terms of regional structure, the global alumina fiber market is mainly concentrated in the Americas, Europe, and Asia. The demand for alumina fiber in the Americas is mainly concentrated in the North American market, represented by the United States. In 2022, the scale of alumina fiber in the Americas will grow to $127 million; The demand for alumina fiber in Asia is mainly concentrated in countries and regions such as China and Japan. By 2022, the scale of alumina fiber in Asia will increase to 67 million US dollars; The consumption of alumina fiber in Europe is mainly dominated by Germany, France, the United Kingdom, Russia, and Italy. In 2022, the scale of alumina fiber in Europe will increase to 66 million US dollars.

4、 The current situation of China's alumina fiber industry

As one of the typical representatives of inorganic ceramic fibers, alumina fibers have excellent properties such as high strength, high heat resistance, and high specific surface area. They are widely used in reinforced composite materials, biomedical materials, adsorption and filtration materials, and other fields. However, at present, alumina fibers still have problems such as difficulty in precise regulation of specific functional structures and inability to be produced on a large scale, which makes it difficult to meet practical applications and needs. Data shows that under the dual promotion of domestic policies and demand, the overall supply of alumina fiber in China continues to grow, but it is still less than one thousand tons. Specifically, China's alumina fiber production has increased from around 102.8 tons in 2017 to 653.5 tons in 2022, but it is still significantly lower than domestic demand. Data shows that China's alumina demand in 2022 was 897.9 tons, and the overall domestic supply can only meet about 70% of the demand.

Related report: Published by Zhiyan Consulting《Report on the Global Market Survey and Investment Opportunity Forecast of China's Alumina Fiber Industry from 2023 to 2029》

Against the backdrop of the overall high-quality development of high-end synthetic fibers, the application field of alumina fibers continues to be extensive, driving demand to continue to improve, which is the main reason for the significant rapid growth trend of the alumina fiber market in China. Data shows that the market size of alumina fiber in China was only 126 million yuan in 2017, with an overall growth rate of around 20% or less from 2017 to 2020. In 2021, the demand for refractory and adsorption filtration in the overall market continued to grow, coupled with improved market recognition and technological development, the market size of alumina fiber in China increased significantly to 244 million US dollars. In 2022, the market size of alumina fiber in China reached 298 million yuan, an increase of 22.1% compared to 2021. In terms of the proportion of scale structure, the proportion of high-temperature insulation materials such as alumina fiber high-temperature furnaces has begun to decrease. Adsorption filtration and structural reinforcement have gradually become the main driving forces for the growth of alumina fiber scale, accounting for 32.3% in 2022, an increase of 6.9 percentage points from 2017.

Aluminum oxide fiber is a key military material for national development and is a key material required by the country. Developed countries in Europe and America have used it as a strategic reserve material, imposing technological blockades on China and banning the sale of some products. Non banned products are sold at high prices and in limited quantities. In addition, China's overall alumina fiber material technology development is relatively late and lags behind developed countries. In the past, the overall alumina fiber was mainly imported. In recent years, with the promotion of relevant domestic technology research and the continuous entry of enterprises driven by demand, China's overall alumina fiber production capacity has continued to grow. While replacing the import volume, the import price of alumina fiber has been lowered. The degree of localization of alumina fiber in China has continued to increase, and the proportion of scale has been reduced. Data shows that in 2022, the domestic scale of alumina fiber in China accounted for about 67%. At the same time, in the past two years, with the increasing demand for alumina fiber in China and the tightening of supply and demand, the overall price of domestically.

5、 Aluminum oxide fiber industry pattern

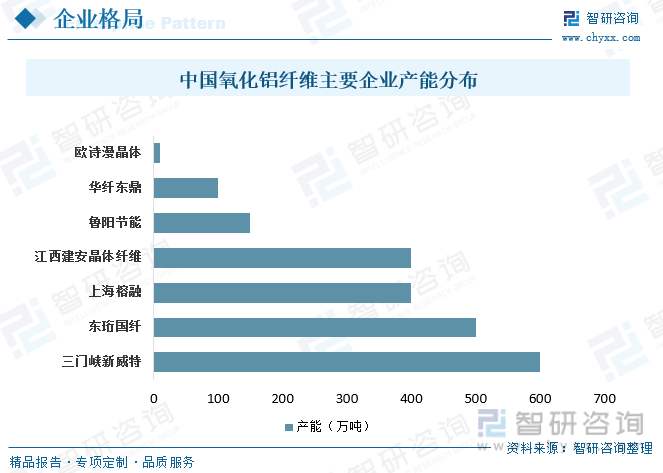

At present, the production capacity of China's alumina fiber industry is about 2000 tons, and the industry enterprises mainly include Luyang Energy saving, Shanghai Rongrong, Dongheng National Fiber, Huaxian Dongding, Xinweite, Oushiman Crystal, Weiye Crystal Fiber, etc. The overall technology in China has been blocked while the development is lagging behind, resulting in an import dependence of over 80%. With the expansion and implementation of overall alumina fiber production capacity in China, the degree of localization continues to increase. At present, the industry is still in a period of capacity expansion. For example, the first phase of the Shanghai Rongrong New Materials Advanced Manufacturing Base project was completed in the Lingang New Area of the Free Trade Zone. This project is one of the major engineering projects in Shanghai in 2022, with an investment of 3.8 billion yuan and an annual production capacity of up to 700 tons. It has the production capacity of high-temperature resistant alumina fiber new materials.

Keywords: # alumina fiber # Dongheng national fiber # alumina continuous fiber # alumina fiber felt # alumina fiber felt # alumina fiber paper # refractory material # insulation material